What is an input tax credit?

In the process of the sale of goods to the end customer or end user, the same goods will be sold by more than one person in the sales chain. For example, Hindustan Unilever Limited manufactures and sells a certain product(GST rate @ 5 %) at Rs.105 (Rs.100 plus GST Rs.5) to its super distributor, and the super distributor sells the same product at Rs. 110.25 to the area distributor (Rs. 105 + Rs.5.25), the distributor sells the product at Rs.115.5 to the supermarket (Rs.110 + Rs.5.5), supermarket Sells it at Rs. 126 to end customer (Rs.120 + Rs.6).

The product GST rate is 5 % which means the government net GST collection from the product sold to the end customer is 5 % on Rs.120 taxable value, which works out to Rs.6.

But these 6 Rs will not be collected fully collected from the final supplier at every point of sale tax is collected at value addition, in our case let us assume the inputs of Hindustan Unilever for production is 0%.

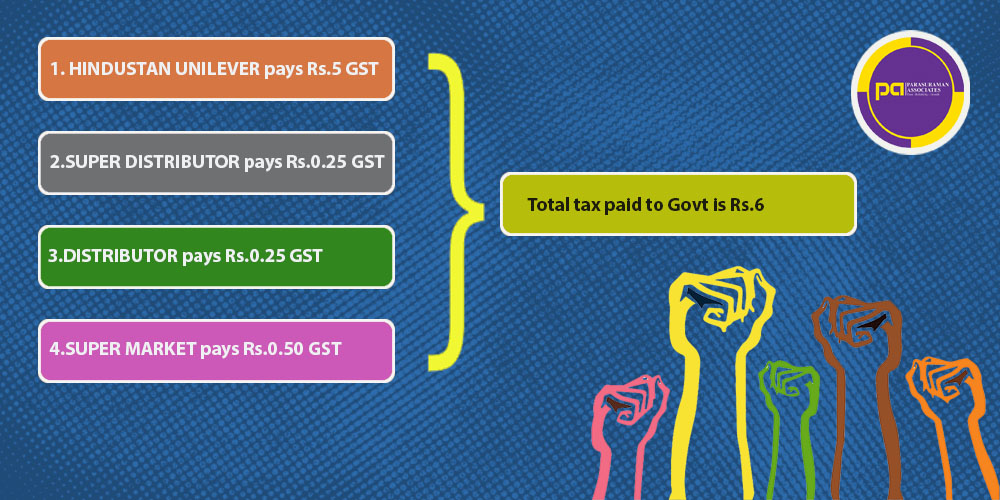

Hindustan Unilever sells at Rs.105 including tax of Rs.5 GST from the super distributor and pays 5 Rs GST to the government as there is no input tax credit available and issues invoice mentioning GST as Rs.5. The super distributor sells at Rs.110.25 including tax of Rs.5.25 and pays tax of Rs.0.25 to the government after deducting tax already paid to Hindustan Unilever, similarly distributor pays Rs.0.25, supermarket pays Rs.0.50, so the total tax collected by the government from all the four-person comes to Rs.6 which is 5 % of final taxable value.

In simple terms, the supplier pays GST at the rate calculated on the value addition made by him in our case value addition made by the super distributor is Rs.5 (105-100) so the net tax payable is 5 % on Rs.5 which works out to be Rs.0.25.

| SL. No | Supplier | Calculation | Tax paid by the Supplier to Government |

| 1 | Hindustan Unilever | 100 * 5 % | Rs.5 |

| 2 | Super Distributor | (105-100)* 5 % | Rs.0.25 |

| 3 | Distributor | (110-105)* 5 % | Rs.0.25 |

| 4. | Supermarket | (120-110) * 5 % | Rs.0.50 |

| The total amount paid to the government by all suppliers | Rs.6.00 | ||

Finally, we can conclude that the GST department collects tax from all suppliers who had completed GST registration applications with the GST department at all levels of sales at the value addition made by them in the sales cycle, the total tax collected will be equal to the sum of taxes collected from all persons in sale cycle which will exactly work out to be tax to be collected if final price.

Advantages of input tax credit system

- The government collects full tax without any evasion as multiple parties are involved in the cycle

- Collection of tax at each level ensures early collection of taxes this eliminates waiting time until the final sale, GST is paid by the supplier during GST monthly return filing tax revenue can be used for objects of the government.

- Suppliers will have a sense of paying less tax as the final liability is only on value addition made by them.

- Forces suppliers to issue invoices to the registered dealer as they need it to claim the input tax credit, so finally suppression of sales is eliminated in these kinds of transactions.

- Suppression of purchases is eliminated in case of transactions between registered dealers as the GST portal efficient input tax credit system.

CALL US

CALL US  EMAIL US

EMAIL US