MSME – Micro-small medium enterprises are the backbone of Indian commerce and contribute a large share to the GDP of the country. To take care of welfare measures, guide, and educate the entrepreneur’s Ministry of Micro, Small & Medium Enterprises is established government of India along with the government of Tamil Nadu provides credit facilities and subsidies to eligible MSMEs.

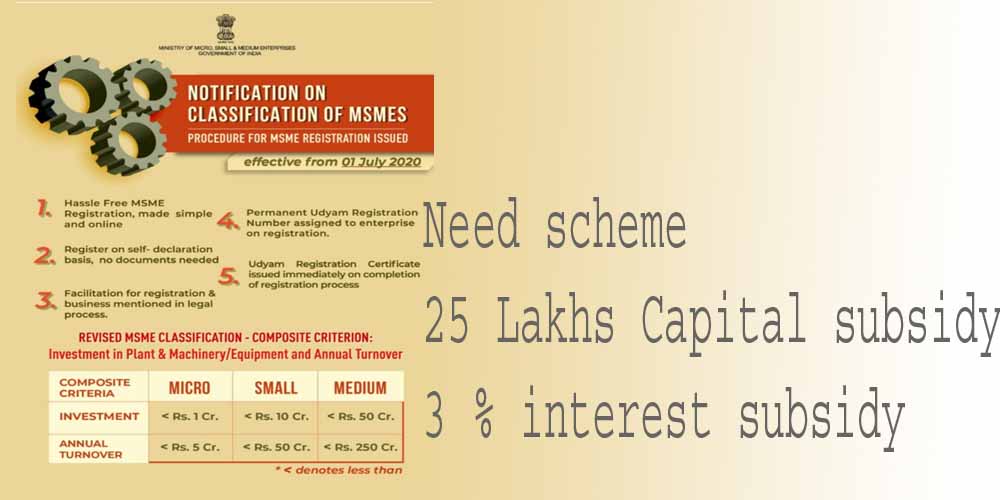

What is a need scheme?

The New Entrepreneur cum Enterprise Development Scheme (NEEDS) is a subsidy scheme provided by the Directorate of Industries and Commerce, Government of Tamil Nadu to encourage and support new and young entrepreneurs, Scheme aims at providing interest subsidy and capital subsidy to educated youth to start a new business. Under this scheme around 1000 entrepreneurs will be trained each year and 50 % of them would be women.

Top 10 Points to take care of while Applying to the Tamil Nadu government needs a scheme

- Manufacturing activity will be given priority

- Female candidates will be given high ranking

- Private limited company, LLP, OPC, the limited company not eligible under the scheme.

- Prefer TIIC for loan applications as they are well suited for MSME loans. TIIC provides additional subsidies on interest and minimum collateral security norms. Enhanced assistance compared to banks.

- Only new machinery or second-hand machinery directly imported by the applicant will be considered for project cost.

- The loan amount will be calculated as per BANK or TIIC norms.

- Collateral security is a must as per bank guidelines. Collateral security relaxation may also be considered under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) for eligible business

- After approval of the subsidy, the business should not be converted to a private limited, LLP, OPC, or limited company to be covered under the scheme.

- The business will be physically verified anytime to make sure conditions are met.

- For the service sector, capital-intensive industries will only be considered.

What is the process of the needs scheme?

Under the needs scheme around 1000 members are selected for the entrepreneur development program and after successfully completing the training program, assistance will be provided by way of subsidy for investment and subsidy for interest. Every eligible member should invest in the capital of the industry as per the scheme, and assistance in the form of a term loan will be provided by the Tamil Nadu industrial investment corporation (TIIC).

What is the eligibility for the need scheme?

Age Limit

Minimum – 21 years

Maximum – 35 years for General Category Entrepreneurs

Maximum – 45 years for Special Category Entrepreneurs (Women / SC / ST / BC / MBC / Minorities /

Ex-Servicemen / Transgender / Differently abled

persons)

Educational Qualification

Degree, Diploma, ITI / Vocational Training from

recognized Institutions.

Place of residence

The applicant should be a resident of Tamil Nadu State

for not less than 3 years.

Distribution of benefits on basis of Reservation

Scheduled Caste (SC) 18%

Scheduled Tribe (ST) 1%

Differently abled 3%

Priority will be given to destitute women

Income ceiling

The benefit is provided irrespective of existing annual income

Persons eligible under the need scheme

Only individuals are eligible under this scheme, and partnerships can apply only if all partners in the firm are eligible under the scheme, training under the scheme will be provided only to authorized partners. Margin norms for partnership firms are to be satisfied by partners also.

How much subsidy under the need scheme

The subsidy is limited to 25 % of the project cost, subject to the maximum amount of 25 lakhs,

A minimum investment of 10 lakhs and a total project value below 5 crores will be given priority.

A 3 % interest subsidy will be provided by the state government directly to the bank.

For project cost up to 50 lakhs subsidies will be provided in 2 instalments and for those above 50 lakhs

How to calculate project cost?

The investment amount should be for capital expenditure, which means it is for the setup of machinery and other infrastructure

| Total project costs | Rs.XXXX | Example Rs. 1,50,00,000 |

| Less : | ||

| a. Cost of rented/leased building (advance paid, rent, b.purchase cost) | Rs.XXXX | 12,00,000 |

| c. Technical know-how | Rs.XXXX | 0 |

| d. Company registration expenses and other admin expenses. | Rs.XXXX | 75000 |

| e. Working capital | Rs.XXXX | 20,00,000 |

| f. Total project cost for calculation subsidy | Rs.XXXX | 11,72,5000 |

| g. Subsidy @ 25 % of (f) | Rs.XXXX | 29,31,250

(Restricted to the maximum amount of Rs.25,00,000) |

How much is promoter contribution?

Promoter contribution should be a minimum of 10% for the general category and 5 % for the special category of persons.

Eligibility of business nature for need scheme?

All viable manufacturing and service activities except the following.

Ineligible business

1. Any activity directly connected with agriculture.

2. Seri culture (Cocoon rearing), Animal Husbandry like Pisciculture, Piggery,

Poultry etc.,

3. Manufacturing of Polythene carry bags of less than 40 microns thickness and

manufacture of carry bags or containers made of recycled plastic for storing,

carrying, dispensing, or packaging of foodstuff

4. Sugar

5. Distilleries, Brewery, and Malt Extraction

6. Units utilizing Molasses/rectified spirit/denatured spirit as raw material for

the manufacture of potable alcohol.

7. Fertilizer manufacture and blending (Except bio-fertilizers)

8. Mining and Quarrying Ores, minerals, etc. [Excluding polishing, cutting, crushing,

etc. of mined ores/minerals]

9. Aluminium, Iron, and Steel Smelting [Excluding foundries]

10. Manufacturing of intoxicant items like Bedi / Pan / Cigar / Cigarette etc.,

11. Saw Mills

12. Cement

13. Calcium Carbide

14. Slaughter House

15. Re-packing of Drugs / Medicine / Chemical, without any processing or value

addition

16. Azoic / Reactive Dyes

17. Fire Crackers

18. Industries manufacturing and or utilizing Ozone depleting substances

19. Industries involving hazardous activities / classified as “Red category” by Tamil

Nadu Pollution Control Board / Central Pollution Control Board

20. Cyanide

21. Caustic Soda

22. Potassium Chloride

23. Nylon, Rayon & Polyester Fibre manufacturing. [Excluding manufacture of

downstream products from Nylon, Rayon & Polyester Fibre]

24. Real Estate

25. All types of Business activities.

How to apply?

It is recommended to consult with the district Commissioner ate of Industries and Commerce before proceeding to apply to comply with rules and regulations, the director will give advice on the scheme and eligibility. Once pre-consultation is over, you can apply subsidy in the need scheme. Once the application is submitted, it will be verified and approved only after all the conditions are satisfied.

CALL US

CALL US  EMAIL US

EMAIL US