Import-export code registration also called IE Code registration is compulsory when the enterprise is engaged in the sale or purchase of goods from foreign countries. In the case of Continue reading “Everything About IE code registration”

Category: Knowledge Desk

How to file income tax salary return ?

Income tax salary return filing is an easy task compared to other income tax returns, like income tax capital gains returns, and income tax business returns Continue reading “How to file income tax salary return ?”

Capital gains tax on sale of property

Introduction to capital gains

Capital gain taxation is introduced in order to tax transactions involving capital assets that are considerably valued higher in a practical sense. Continue reading “Capital gains tax on sale of property”

Importance of optimizing income tax and loan goals

Income tax return filing is one of the top priorities for every business intending for proper compliance. The importance of income tax filing is well known by businessmen who wish to expand their business Continue reading “Importance of optimizing income tax and loan goals”

Why Income tax department send notices Under Section 142(1) ?

Section 142(1) notices are one of the important and frequently sent notices to the assesses, it is one of the important notices sent requiring the assessee to furnish the return of income or provide such other documents required to be submitted. Continue reading “Why Income tax department send notices Under Section 142(1) ?”

How to prepare GST invoice in proper format with details ?

GST invoice is the primary commercial document that is issued by the supplier of goods or services to the recipient, and it is also issued to the seller of goods in some cases. Continue reading “How to prepare GST invoice in proper format with details ?”

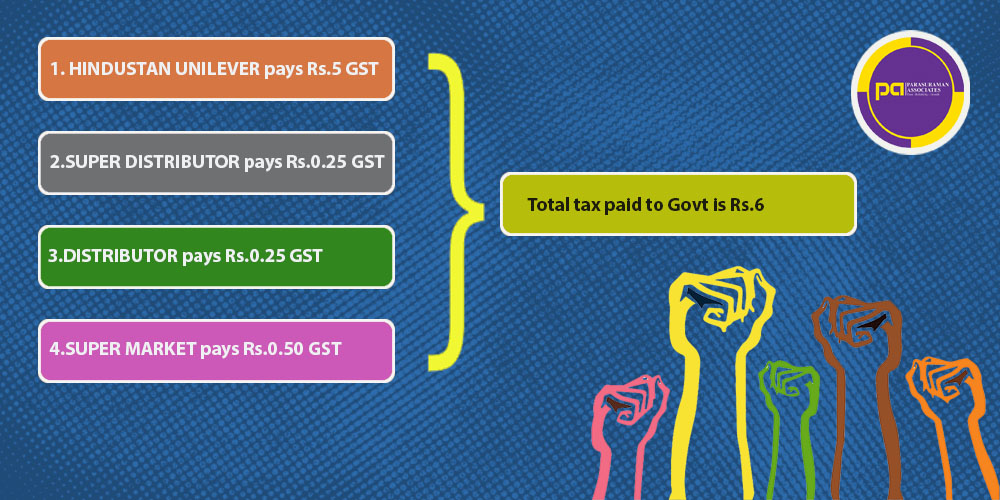

What is input tax credit in gst and how to calculate it ?

What is an input tax credit?

In the process of the sale of goods to the end customer or end user, the same goods will be sold by more than one person in the sales chain Continue reading “What is input tax credit in gst and how to calculate it ?”

Deep analysis of cash transactions under income tax

Cash is the most liquid asset in the world and gives much more flexibility in business and personal transactions due to its acceptance and its ability to be used for transactions with anyone and in any situation. Continue reading “Deep analysis of cash transactions under income tax”

What is advance tax and how to calculate ?

Income tax is normally paid after the end of the financial year, however, if the estimated net tax liability is Rs.10,000 or more during the financial year then the taxpayer should pay tax in the same financial year Continue reading “What is advance tax and how to calculate ?”