Partnership firm registration is one of the flexible and cost-effective business structures for startups and established businesses already registered as proprietorship firm.After issue of partnership registration certificate by registrar of firms there are very few compliances to keep the partnership registration active with the registrar of firms.

The government of Tamil Nadu had implemented online application for partnership firm registration , compliance process, renewal of partnership firm, amendment of partnership firm to reduce the time frame partnership registration application submission, renewal application, amendment application for partnership firm details.

Once registration certificate is issued under new online system, the login facility will be available to all firms to amend partnership deed registration, renewal of partnership firm, and submission of other forms.

Application for issue of firm registration login credentials

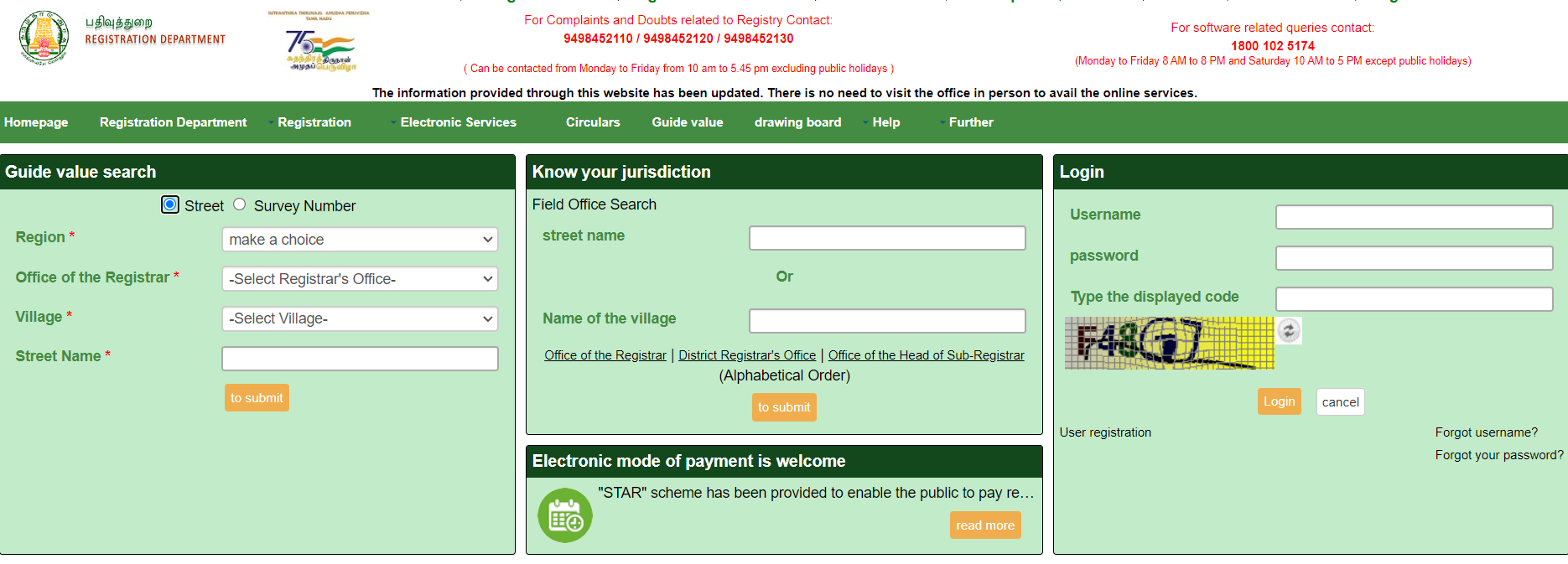

All the process related to partnership firm registration can made only in online mode through https://tnreginet.gov.in/,

With effective from 2021 online registration of partnership firms is implemented, and for those firms which had applied for partnership firm registration before 2021 need to apply partnership firm login credentials through partnership firm login creation application form.

Once the login requisition application is submitted to registrar of firms user ID and password, after verification of the application, a login will be issued to the registered e-mail ID provided in the firm registration login application.

Partnership firm registration certificate download facility will be available in a new format after login is issued, all the process needs to be carried out through respective login once the login is issued.

Renewal of partnership firm registration

Partnership company registration should be renewed every year by filing a partnership firm renewal application also called as an annual declaration with the registrar of the firms, the due date for filing a partnership firm renewal application is June of the following financial year, and the declaration ensures that the partnership firm is active and with robust compliance.

The annual return is a mandatory document to be filed every year for partnership registration renewal in Tamil Nadu, if the the annual return is not filed within the due date penalty of Rs.25 is payable for every 3-month delay in filing the annual return.

Any applications relating to the partnership firm will be approved only after the pending annual returns are filed, it is advisable to file annual returns every year to avoid hefty penalties later.

Application for adding and removing partners

If there is a change in partners by adding a new partner or removing an existing partner, it should be updated by filing the application for change in the partners of the firm. Once the application for change in the constitution of the firm is approved, only active partners can sign all the forms for the period after the amendments.

Documents required for amendment in the partners of the firm

- Partnership amendment deed for removal of partner.

- Partnership amendment deed for the addition of a partner.

- Notarized application for change in the constitution of the firm.

- New partner’s Aadhaar card, permanent mobile no, and permanent e mail ID.

How to prepare a partnership deed amendment for adding and removing a partner?

The starting paragraph in the Partnership amendment deed should refer to the original partnership deed, and partnership firm amendment deeds already executed with the particulars of the date and name of the amendment deed.

There should be a minimum of two persons for keeping the partnership firm legally valid, therefore before preparing an amendment deed for the removal of a partner, it is recommended to ensure that the number of partners will not fall below 2 persons.

During the removal of the partner, adding a new partner, and transferring the partnership rights to another person, there will be a change in the profit-sharing ratio, capital of the firm, etc. When there is a change of partners in the partnership firm it is crucial to mention the capital that is brought in by the new partner and the amount paid to the resigning or outgoing partner. Each partnership amendment deed should be prepared with non-judicial stamp paper for an amount of rupees One thousand.

Application for change in the registered address of the partnership firm

Change the registered address of the firm, by applying for the change in principal place of business.

Documents required for amendment deed for change in address of the firm

- Amendment deed for change in the registered address.

- The application for change in the registered address of the firm with attestation by the notary.

- Rental agreement and supporting utility bills if there is already GST registration for the partnership firm, or where GST registration is required to be applied in a short span.

How to prepare an amendment deed for change in the business address of a partnership firm

A partnership amendment deed for a change in business address should be executed only after the date of the rental agreement for a new address, rental agreement provides an additional layer of legal validity.

It is suggested that the address as per the TNEB database is used in the amendment deed so that, there will not be mismatch between the address as per the TNEB summary electricity bill and the partnership amendment deed for the purpose of GST address amendment.

GST registration will be approved, only if the address in the electricity payment bill, the rental agreement, and the partnership amendment deed are the same.

Similarly, a change in the address of the branch also be applied to the registrar of firms by application for change in branch details.

Application for change in partner details

Change in details of the partners such as the address of the partner, contact information, or change in any other particulars need to be updated with this application.

It is recommended to add the partner’s name without initials and add the father’s name instead, as per legal documentation guidelines name of the father should be added along with the name of the person.

Application for dissolution of partnership firm

Dissolution of the partnership firm means, permanently closing the partnership firm in legal terms, this is the last step for closure and surrender of partnership registration certificate.

Partnership firm dissolution application shall be filed with the registrar of the partnership firm Tamil Nadu, with particulars such as the date of dissolution, the date of filing the last annual return, and the partnership firm dissolution deed signed and notarized by all the partners.

Cancel all the partnership GST registration numbers including the branch GST registration which is applied in the name of the firm, and proceed to partnership firm dissolution only after the GST registration certificate is canceled by the department and the GSTR-10 final return is filed.

How to get FORM-A for a partnership firm?

What is FORM-A for a partnership firm?

FORM-A is the statement provided by the registrar of the firms for the applicant regarding date of various compliances etc.

Contents of FORM-A

- Date of issue of Partnership firm registration certificate.

- History of change in registered address and branch address with date of such change.

- List of partners with date of joining and date of retirement.

- Alteration in particulars of partners such as profit sharing ratio, address etc.

- Change in name of partnership firm.

- Date of filing annual return, amendment application etc.

Importance of Partnership firm FORM-A

- Required for government tender applications

- Services as proof that the firm had filed the annual returns, partnership firm amendments etc.

- It is like a diagnosis report issued by registrar of firm for the use of third party vendors, financial institution, customers etc.

- Serves as a legal document in court of law in case of disputes between the partners and third parties.

- Helps the new incoming partners to conduct due-diligence before investing or becoming a partner in the existing partnership firm.

Steps to get FORM-A for partnership firm ?

- File all the pending annual returns and amendments application.

- File Online application along with required e-payment.

- Submit the copy of online application along with the payment challan, required judicial stamp duty, and supplementary manual application form containing the particulars of the partnership firm.

- Once the payment is verified and approved by the registrar of firms FORM-A will be issued in hardcopy.

What is the process for a partnership firm amendment registration?

- Prepare and sign partnership amendment deed wherever it is required.

- File respective partnership amendment application with details of change as per the executed amendment deed and prescribed documents supporting the change like, address proof, amendment deed etc.

- Make the payment for submitting the amendment application.

- Notarize the application and submit to the department with all the documents that are submitted online.