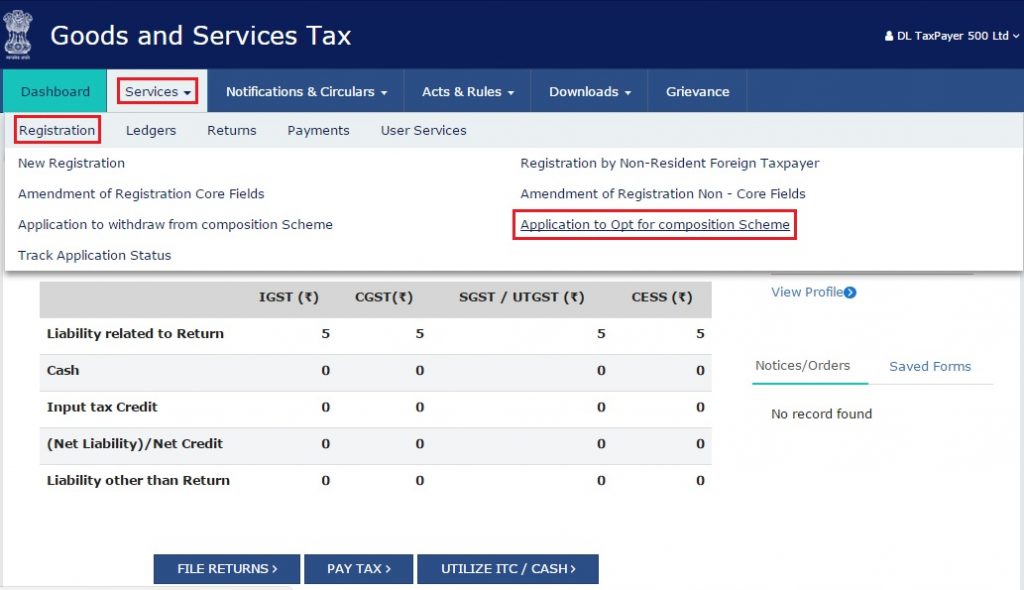

Fast track GST registration scheme Under Rule 14A and 9A within 3 Days

To facilitate easy and quick business setup for small business owners Government of India had introduced a simple and quick GST Continue reading “Complete Guide on GST registration auto approval in 3 days under Rule 14A & 9A”