A person can apply GST registration number to comply with the GST Act on a mandatory basis or to voluntarily utilize the benefits under the CGST Act 2017. Continue reading “How reply GST registration query notice?”

Category: GST

Income tax return filing and GST registration for partnership firm

Guide on Income tax return filing and GST registration for partnership firm

A partnership firm is regarded as a separate person as per the Income Tax Act and GST Act, Once the partnership deed is prepared and signed by all the partners, Continue reading “Income tax return filing and GST registration for partnership firm”

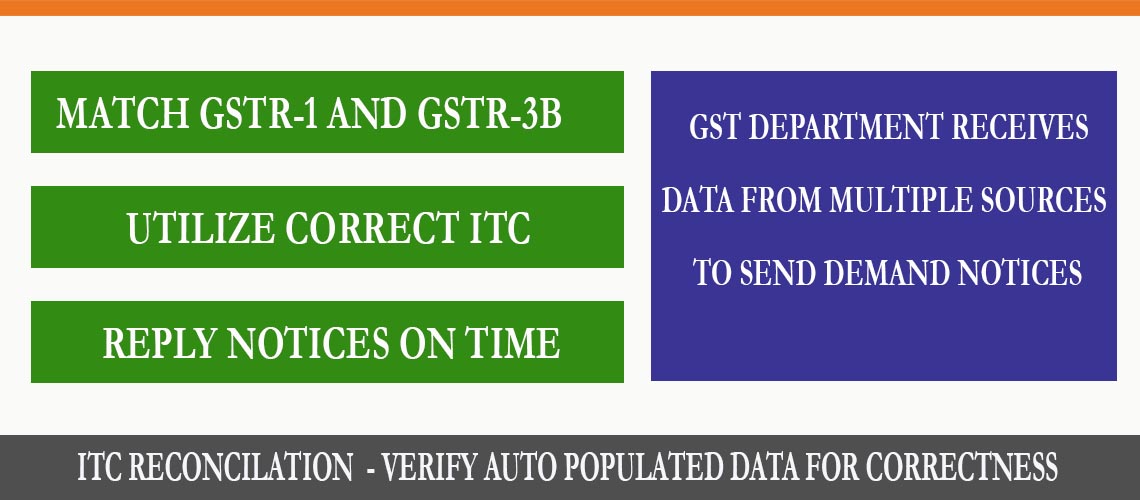

What happens if GST returns are not filed correctly?

GST return is one of the important aspects in compliance with the GST Act, the data submitted in the monthly or quarterly GST return filing provides important information to the department for assessment of GST tax liability payable by the dealer. Continue reading “What happens if GST returns are not filed correctly?”

What is GST notices and assessment process in GST Act?

What are GST notices and assessment processes in the GST Act?

GST is a trust-based tax regime where the taxpayer is required to self asses the tax payable and file the returns without any initiation by the tax officer or department. Continue reading “What is GST notices and assessment process in GST Act?”

Important things to follow after GST registration ?

As a first task in this article, we would like to thank you for being a part of building the nation by compliance with GST registration laws. GST is a trust-based tax regime Continue reading “Important things to follow after GST registration ?”

How to file GST return ?

What is GST return filing?

GST is the tax collected by the government if a person engages in a taxable supply of goods or services Continue reading “How to file GST return ?”

When and How to apply GST registration ?

What is GST Online registration?

GST registration is the process by which a person Continue reading “When and How to apply GST registration ?”

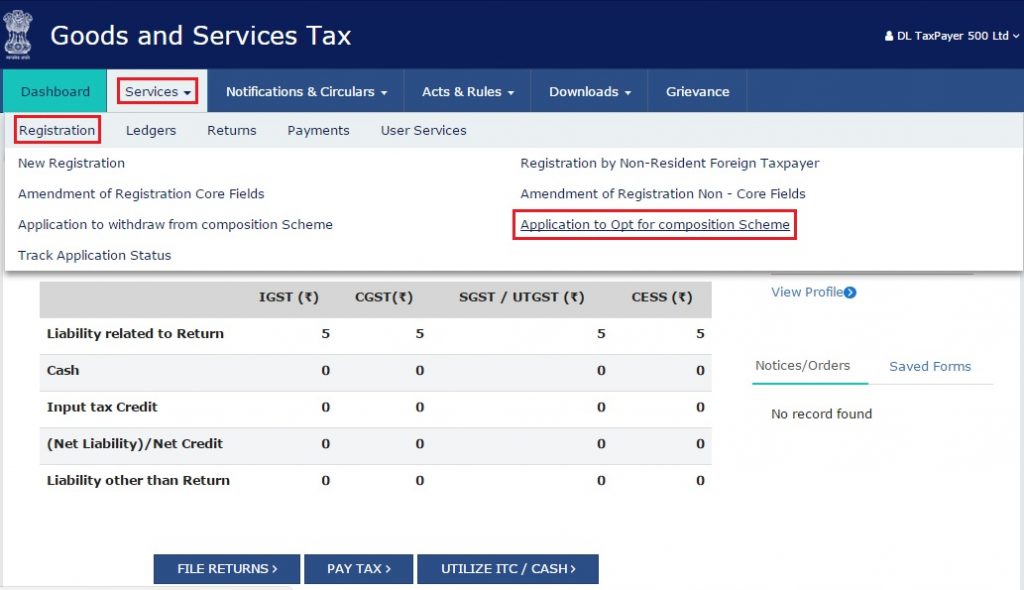

GST Registration in composition scheme

When to apply GST registration based on turnover ?

GST registration is mandatory for all dealers if aggregate turnover exceeds Rs.20 lakhs in the financial year, Continue reading “GST Registration in composition scheme”

Complete guide on GST registration for E commerce sellers

GST registration is mandatory for all supplier of services and goods if aggregate turnover crosses Rs.20 lakhs in a financial year for composite supply of goods and services, Continue reading “Complete guide on GST registration for E commerce sellers”