When to apply GST registration based on turnover ?

GST registration is mandatory for all dealers if aggregate turnover exceeds Rs.20 lakhs in the financial year, the limit is Rs.10 lakhs for special category states. For state of Tamil Nadu the turnover limit is Rs.20 lakhs, this article is aimed to provide clear picture so for simplicity the limits applicable for state of Tamil Nadu is considered in all places.

The above limit is further increased to Rs.40 lakhs for person who is engaged in exclusive supply of goods, for supplier of services and dealer who supplies goods as well as services the limit of Rs.20 lakhs continues.

Therefore, if the aggregate turnover exceeds Rs.20 lakhs for service provider, or 40 lakhs for exclusive supplier of goods, the person is liable under GST act to apply GST registration number within 30 days from the date of liability.

Apart from registration based on turnover, mandatory registration is applicable based on nature of business and status of business. The detailed guide on GST registration applicability can be found on Who are required to Apply GST registration.

What is GST composition scheme ?

GST composition scheme is a simplified scheme for payment of taxes, filing of returns, for the benefit of small business owners whose aggregate turnover does not exceed a specified amount in previous financial year.

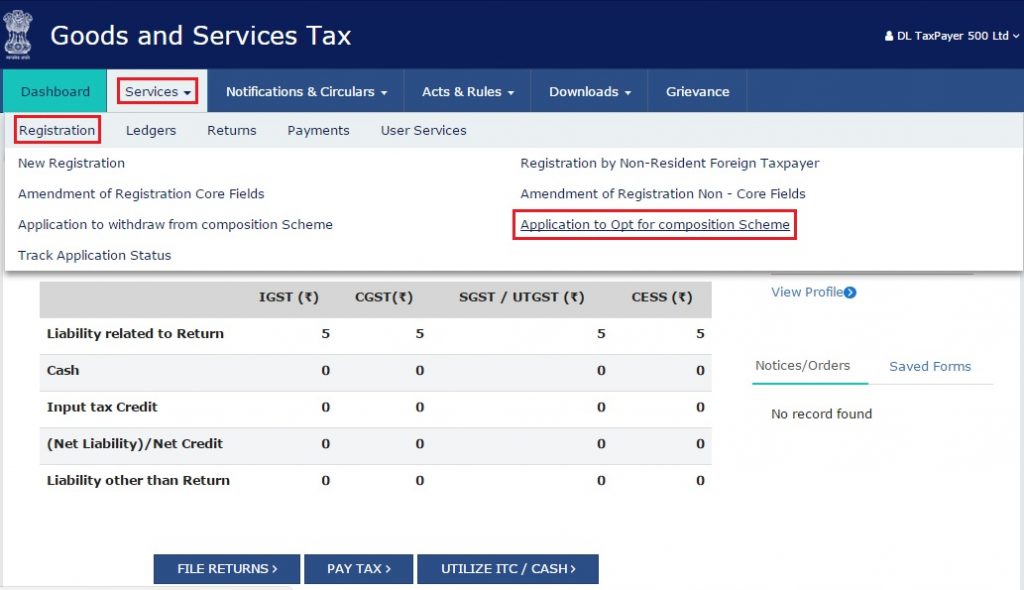

It is the option available to small taxpayers to pay tax at a fixed percentage on value of taxable supplies, this option is to be exercised at the time of registration or before the commencement of financial year for already registered dealers.

The limit of Rs.1.5 crores is applicable for following types of business with prescribed rate of tax U/s 10 (1) of CGST Act

Registration or option for payment of taxes under composition scheme can be opted if turnover in the preceding financial year does not exceed Rs.1.5 crores.

- Manufacturer – SGST @ 0.5 % and CGST @ 0.5 %.

- Restaurant services – SGST @ 2.5 % and CGST @ 2.5 %.

- Other business (except service providers) – SGST @ 0.5 % and CGST @ 0.5 %.

- Earlier composition scheme was not available to supplier of goods through e-commerce operators w.e.f from 1st Oct 2023 ecommerce supplier of goods can opt for composition scheme.

- Composition scheme is not applicable for service provider under section 10 (1) in 1.5 crores aggregate limit.

- In case of service providers, only dealer providing restaurant services can opt for composition scheme.

- Considering practical difficulties in providing exclusive supply of goods

- Restaurant service provider should opt for composition scheme only under this section.

- Dealer opting for composition scheme under this section can supply service for value up to higher of 10 % of aggregate turnover of previous year or up to Rs.5 lakhs, other than restaurant services.

Composition scheme for service provider U/s 10(2A)

A person providing taxable supply of services can opt for composition scheme of payment of taxes under section 10(2A).

A service provider is eligible to opt for this scheme, if their aggregate turnover does not exceed Rs.50 lakhs in the preceding financial year.

Supply of taxable services can be made up to value of Rs.50 lakhs in a financial year under composition scheme for service providers.

The eligibility limit for entry in the scheme and turnover limit for payment o f taxes is same for all states, there is no distinction between special category states and other states.

Rates of taxes for composition scheme for service provider is SGST 3 % + CGST 3 %, hence total tax rate is 6 %.

Common conditions to be satisfied by all composition taxpayers

- A person registered under composition scheme cannot make interstate supply (out of state)of goods or services, therefore exports of goods as well as supply to SEZ is not allowed for composition taxpayer. Interstate purchase of goods and services are allowed, restriction of interstate transaction is only for outward supply that is sales.

- Aggregate turnover for purpose of computing eligibility to opt for composition scheme is inclusive of exempted supplies, exports etc but does inward supplies received under reverse-charge mechanism.

- Option to pay tax under composition scheme should be availed by all persons registered under same PAN.

- Option for composition should be taken for all taxable supplies, supply for certain goods under normal rates and other goods under composition scheme is not allowed.

- Customers of composite dealers cannot take input tax credit, therefore input tax credit is not transferred to buyers.

- Tax invoice should not be issued by the dealer who opted for composition scheme, therefore bill of supply should be issued to customers.

- Tax should not be collected from the customers, therefore amount of tax should not be shown separately in the bill of supply.

- The words “composition taxable person, not eligible to collect tax on supplies” shall be mentioned in the top of bill of supply issued for supply of taxable service or goods.

- The words “composition taxable person” shall be mentioned at notice board, sign board at principal place of business and all other places of branches etc.

- The Scheme is not eligible for casual taxpayer, person making interstate supplies, supplier of goods which are not chargeable to tax, manufacturer of certain goods.

Procedural requirements for composition taxpayer.

- Payment of taxes computed at a fixed rate on the value of supplies made during the quarter should be paid on or before 18 of the succeeding month in FORM GST CMP-08. For example, for April 2023–June 2023, payment of taxes should be made on or before 18th of July 2024.

- Return should be filed for financial year on or before 30th or April of following year, in form GSTR- 4.

- Details such as value of inward supplies received from registered as well as unregistered dealers shall be furnished.

- In case inward supplies are received from unregistered dealers, tax at normal rates shall be paid by the composite dealer on reverse-charge basis.

- ITC cannot be availed against goods lying as stock of finished goods, semifinished goods etc, on opting in the scheme. Similarly, when opting out of the scheme, input tax credit can be taken against inputs used lying as stock of finished goods, semifinished goods etc.

- Voluntary withdrawal from the scheme can be made any time during the financial year by filing FORM GST CMP-04, once withdrawal intimation is filed it is deemed that intimation is filed for all the registrations under the same PAN, dealer should be cautious before withdrawal from the scheme because once exited from the scheme during the financial year, re-entry is possible only for next financial year. In simple terms, entry in to the scheme before financial year and exit any time during the financial year.

- Mandatory withdrawal from the scheme is required when the dealer fails to satisfy any of the conditions mentioned in section 10. The intimation in FORM GST CMP-04 shall be filed within 7 days from the violation of conditions for composite dealer.

- If the officer founds any violation in conditions for composite taxpayer, he can issue show cause notice in FORM GST CMP – 05 to explain why the option should not be cancelled from the mentioned date in the SCN.

- On receipt of the notice, the dealer should reply with in 15 days in FORM GST CMP-06 with in 15 days.

- In case if the reply is received, the officer should either accept the reply or deny the reply and pass final order with in 30 days from the receipt of reply or on expiry of time limit for reply by the dealer.

- Penalty proceedings under section 73 and 74 can be initiated for contravention of provision of section 10.

- Additional returns for transition in to the scheme and out of the scheme are required to be filed.

Advantages of composition scheme

- GSTR -1 and GSTR-3B is not required to filed for each month, this will reduce compliance burden to prepare GST data each month and GST filing.

- Savings in penalty, late fees, interest because payment of taxes are required to be made only on quarterly basis, this will also increase working capital of the dealer.

- High profitability in certain cases for composite dealer when the rate of GST is high on outward supplies and lower rate on inward supplies, due to reduced GST rates for outward supply of goods and services.

- No stress from customer to file GST return on time, because buyers cannot take input tax credit and there is no transfer of input tax credit to the dealer, customers will not block payments for delay in GST return filing.

Professional guidance from GST expert

- Composition scheme should be opted only when is it financially beneficial for the dealer, when there is no additional profitability in composition scheme it is wise to stick on to as a regular dealer.

- This scheme is practically useful only when customers are unregistered dealers, registered dealers always prefers to avail ITC and deal with regular dealer.

- When the supply of goods or services is majorly to B2B, the composition scheme will result in loss of business, and it is exposing your self that the business is small scale business. This will reduce credibility of business when dealing with corporates.

- Get support of professional GST registration consultant before opting for GST composition scheme.

- Officer can issue SCN for cancellation of registration if quarterly returns are not filed for a continuous period of 4 quarters.

- If there is any delay in payment of taxes on due date, interest is required to be paid along with payment of taxes.